The Democratic Stationary Bandit

The modern welfare state is what happens when you mix Ghenghis-Khan with Classical Athens

Introduction

Many hold the image of modern welfare states as the result of an enlightened mentality of modern people that leads to the creation of institutions to redistribute income. But, as we will see below, the degree of income redistribution and the magnitude of the burden of taxation instead shows that if conceived as a way to minimize variance in incomes, the modern welfare state is a highly dysfunctional institution. Instead, a quick review of the history of the State shows that the modern welfare state emerged spontaneously due to political economy constraints.

The economic argument for redistribution and its relation to the welfare state

The theoretical argument made by economists since the time of James Mirrlees in defense of income redistribution is based on the following assumptions:

(1) People are risk averse. That is, people prefer to have a constant income than to have the same level of expected income but with high variability. For example, everybody prefers to have a fixed income of 50,000 dollars per year with certainty over the next 20 years rather than a fixed income stream over the same period with the same expected value but which can be either 0 dollars or 100,000 dollars per year with a 50% chance.

(2) People cannot privately insure against uncertainty regarding future incomes when they are very young. Most uncertainty in terms of a person’s future income is resolved early in life: by the time someone is an adult with a fully mature brain by the age of 25, most uncertainty regarding their future income level has been resolved.

So the logic goes: as people are risk averse, they want to insure against future uncertainty in their incomes. Because people in general, but especially young people without fully developed brains, cannot voluntarily consent to insurance contracts decades into the future, there is the possibility for the State to provide this insurance in place of private markets.

The practical consequence of this argument for the welfare-state

However, that theoretical perspective, if applied to the real world, brings the following questions:

(1) How much this sort of insurance policy would cost in terms of aggregate income?

(2) Does this insurance policy justify the size of welfare states?

(3) Also, is the pattern of taxation and redistribution present in modern welfare consistent with this model?

How can we answer these questions? My answers, given my current state of knowledge, are the following:

(1) Even if risk aversion is very high, less than 5% of income would be redistributed under an optimal policy.

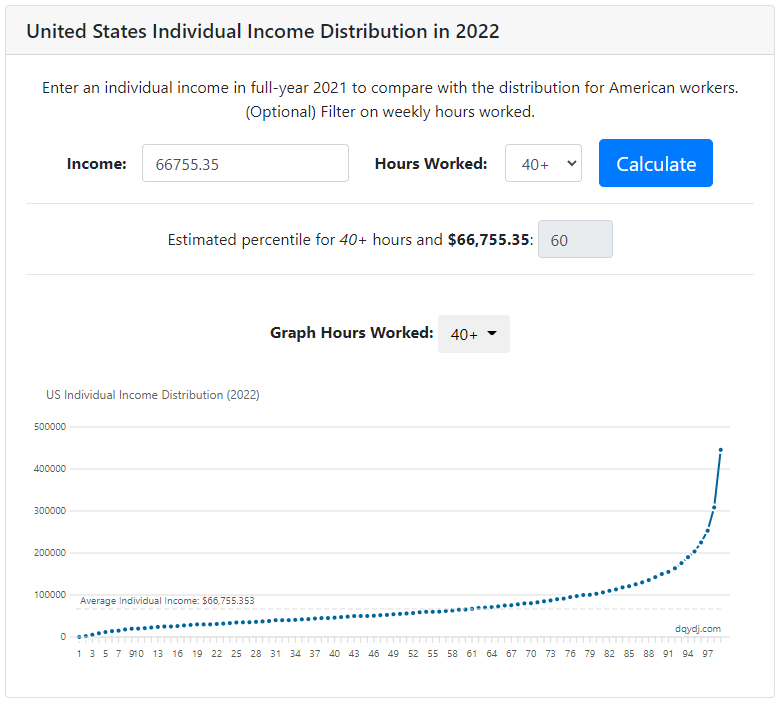

Suppose people are very risk averse, so they want an insurance policy that guarantees that their incomes will not fall below, around, let’s say, 50% of the average earnings (which were 66,800 dollars for full-time US workers in 2021) and constitute about 60% of median earnings. From the data on US (pre-tax) earnings distribution, we can see that only 24% of workers made less than 33,400 dollars, and their average income was roughly 22,000 dollars:

Therefore, such a pretty strong redistribution policy would imply 11,400 dollars to be redistributed per worker towards 24% of the US workforce, which would mean ca. 40 million workers receiving 450 billion dollars, which is less than 2% of the Gross Domestic Income (GDI) of all people in the US in 2021 of 23.44 trillion dollars as estimated by the BEA.

Even if you increase the target minimum income level to about 60% of the average income, that is a minimum target income of 40,000 dollars, close to 75% of the median income; only 33% of workers made less than that. The average income of such workers was ca. 27,000 dollars, which means about 13,000 dollars to be redistributed per worker towards 33% of the US labor force, or ca. 55 million workers receiving 700 billion dollars, which is 3% of the US’s GDI.

So we can say that the insurance model of redistribution can justify upwards of 2-3% of total income to be redistributed if workers are very risk averse. In addition, if we assume there is a large disabled population that is unable to work, we can increase this estimate. Suppose we assume that for ten working individuals, there is one working-age person who is physically unable to work (an extremely strong assumption, in my opinion); supporting them with generous 30,000-dollar annual transfers would cost less than 2% of GDI (30k times 15 million), implying that the total cost of an extremely generous redistribution system should be around 3.5% to 5% of GDI.

(2) Modern welfare states tax around ten times more than suggested by the public economic model that justifies redistribution.

The tax burden in countries with very big welfare states like France, Sweden, Denmark, and Belgium is around 44-45% of GDI, roughly ten times larger than suggested by our model of taxation and redistribution as an insurance policy. Clearly, the Mirrleesian model of redistribution cannot remotely explain the enormous size of modern welfare states.

(3) There is not a lot of actual redistribution going on inside welfare states.

In addition, one important element of modern welfare states is that they tax mostly the middle class, and most expenditures also go to the middle class. So instead of taxation serving as a method to redistribute income from the rich to the poor, it functions as a method of extracting money from the middle class in “exchange” for services provided to the same middle class.

For example, the degree of progressivity in taxation in the Nordic countries is actually much smaller than in the United States: while average taxes are higher, the difference in taxation levels occurs entirely in regard to the middle class. The top 5% in both the US and the Nordic countries pay similar taxes, while the ones in the median pay much higher taxes in the Nordic countries.

Thus, we conclude that the Mirrleesian model of redistribution, while important to justify some degree of welfare spending, does not provide an explanation for the scale and nature of modern welfare states.

The fact is the States never were here to help: the stationary bandit model of the State.

There is extreme ignorance not only among the general public but also among economists and other social scientists regarding the true nature of the State. The State is not and never has been an organization with some inherent tendency to satisfy some social efficiency criteria or to provide “basic services” to the population. The State is fundamentally a predatory organization.

As explained by people like Mancur Olson, historically, States are organizations that emerged from military domination: initially, States were essentially tribes of semi-nomadic bandits who obtained their income by systematically sacking the agricultural villages inside their territorial sphere of control. The borders of states are just the borders of territories of these bandits: they killed the bandits from other tribes who invaded their hunting grounds.

Initially, these semi-nomadic tribes just sacked random villages. As they sought to minimize losses in conflicts with other predatory semi-nomadic tribes, over time, these territories became well-defined, and instead of sackings that occurred randomly, the horse-riding bandits found it was to their advantage (because people were risk averse) to force the population to “share” a fraction of their output in the form of “tribute,” that is taxation. That way, the bandits could maximize revenues from their subject population. That way, the modern concept of a territorial state was formed.

A country’s territory is a territory in which there is a single organization that is virtually the sole predator of the economic activity of its population, and this organization is the modern Territorial State. It can be described as a Nation State when the population of this territory has a substantial degree of shared identity.

Democracies as a way to prevent subjection to stationary-bandits

The first democracies emerged as ways for the subject population to minimize the damage to their property incurred by these stationary bandits. In original democracies, the population became part of the State in the form of Citizens instead of just being tax-paying Subjects. Since States are organizations based on coercion, these citizens were always people armed with weapons: that is why in Classical Greek democracies, the citizens consisted of hoplites, who had armor and weapons, and why in recent centuries, the citizens of the United States have developed a strong culture of gun ownership. In these rare cases, the distinction between the State and its subject population became less visible as people with weapons could not be easily subjected to bandits, and in this case, the State was not simply a predatory organization but an organization of free citizens who joined arms together to defend themselves and their property from external aggression.

One historical episode, the Persian wars, was essentially a textbook case of a war in which the population of a set of such agricultural villages managed to form democratic states to resist the attempts of subjection to a large stationary bandit, the Persian Empire. While the Persian Empire is the textbook case of a stationary bandit that evolved from semi-nomadic tribes of Central-Asian horse riders into a centralized empire.

These dynamics explain why historically speaking, sovereign States that were not just predatory in nature were small city-states of armed citizens and also why these city-states, in which citizens’ property and contracts were respected, tended to be much more prosperous than large territorial states.

The welfare state is a combination of democracy with a stationary bandit.

Modern welfare states are very recent creations. They emerged during the 19th century when States started to become constrained by liberal ideology. Liberal ideology is, in a sense, just the intellectual formalization of the principles that emerged spontaneously in ancient democratic city-states. But, in modern times, as they became part of the dominant ideology in developed countries, they started to constrain traditional predatory states. Thus, the modern States of the developed world tend to minimize their predatory nature through checks and balances provided by modern institutions, such as the separation of powers, that were originally devised as a way for modern large states to mimic the non-predatory nature of small democratic city-states.

However, if modern States institutions are set up in a culture that emerged from traditional predatory States, these States did not become natural democracies where individually armed citizens are not easily subjected to a central political authority. Instead, we ended up with a “democratic predatory state” in which the State still is predatory like a stationary bandit, but instead of concentrating all the tax revenues for the consumption of its tiny elite in the imperial court, the resources of the tax revenues are also used to provide consumption to a large fraction of the population, thus providing this State with majority popular support.

You can think that France is the textbook example of such a State: for centuries, France was the largest State in Europe with both the largest population and tax revenues, which were used to support an opulent imperial court that built the palace of Versailles:

As these States are essentially a mix of stationary bandits with institutions that were originally developed for people to protect themselves from such bandits but instead were re-designed to justify and blunt the popular rejection of high levels of taxation, we ended up with modern States that, in combination with democratic incentives and high levels of productivity, can tax over 40% of the income of their subject population without a high risk of popular rebellion.

Conclusion: Sweden is when Ghengis Khan meets Classical Athens

We cannot say that modern states are just some form of social welfare function-maximizing agent but instead are large complex organizations that are composed of heterogenous groups with different interests. The case of the modern Welfare State is a combination of the ancient stationary bandit Persian-style State but augmented with modern democratic institutions that allow it to tax at much higher levels but also to enjoy higher levels of stability and popular support.

Thus, modern welfare states are not entirely predatory organizations, but the size of the State reveals that their predatory component remains substantial. Also, modern welfare states are not entirely democratic polities in the original (ancient) sense of a community of armed individual property owners who, being equal to each other in the political sense, joined forces to defend themselves and their property.

"The tax burden in countries with very big welfare states like France, Sweden, Denmark, and Belgium is around 44-45% of GDI, roughly ten times larger than suggested by our model of taxation and redistribution as an insurance policy."

But the government budget is not spent mainly redistribution.

For instance, in the US welfare is typically less than 4% of GDP (not GDI—but the only stat I could access quickly!) https://www.usgovernmentspending.com/welfare_spending_history

In Sweden the welfare spend 2020 was about 12bn kroner. https://www.statista.com/statistics/530808/sweden-social-welfare-expenditure/ Meanwhile the total Government spending was 1.2tn kroner, so social welfare was about 10% of government budget.

So it looks to me that Sweden's welfare spend is exactly as the social insurance model predicted.